Cash flow statements show the exchange of money between a company and the govemment also over aperiod of time.()

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“Cash flow statements show the …”相关的问题

更多“Cash flow statements show the …”相关的问题

第1题

Financial statements include balance sheet, income statement and cash flow statement.

A.Right

B.Wrong

C.Doesn't say

第2题

A.Balance Sheet

B.Income Statement

C.Statement of Cash Flow

D.Statement of Retained Earnings

第3题

A.Issuance of debt has no effect on cash flow from operations.

B.Periodic interest payments decrease cash flow from operations by the amount of interest paid.

C.Payment of debt at maturity decreases cash flow from operations by the face value of the debt.

第4题

A.Balance Sheet

B.Income Statement

C.Cash Flow Statement

D.Chairman’s Statement

第5题

第6题

A.net income than C Company.

B.working capital than C Company.

C.investing cash flow than C Company.

第7题

Two software companies that report their financial statements under U.S. GAAP (generally accepted accounting principles) are identical exceptas to how soon they judge a project to be technologically feasible. One firm does so very early in the development cycle while the other usually waits until just before the project is released to manufacturing. Compared to the company that judges technological feasibility early, the one that waits until closer to manufacturing willmost likely report lower:

A. financial leverage.

B. total asset turnover.

C. cash flow from operations.

第8题

between your firm and the client regarding a material issue. You are reviewing the going concern section of the audit

file of Dexter Co, a client with considerable cash flow difficulties, and other, less significant operational indicators of

going concern problems. The working papers indicate that Dexter Co is currently trying to raise finance to fund

operating cash flows, and state that if the finance is not received, there is significant doubt over the going concern

status of the company. The working papers conclude that the going concern assumption is appropriate, but it is

recommended that the financial statements should contain a note explaining the cash flow problems faced by the

company, along with a description of the finance being sought, and an evaluation of the going concern status of the

company. The directors do not wish to include the note in the financial statements.

Required:

(b) Consider and comment on the possible reasons why the directors of Dexter Co are reluctant to provide the

note to the financial statements. (5 marks)

第9题

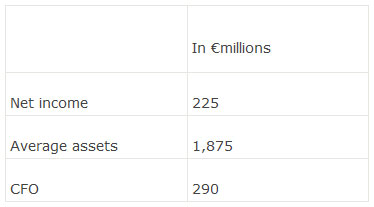

Lazlo Ltd, a European-based telecommunications providers, follows IASB GAAP and capitalizes new product development costs. During 2012 they spent €25 million on new product development and reported an amortization expense related to a prior year’s new product development of €10 million. Other information related to 2012 is as follows:

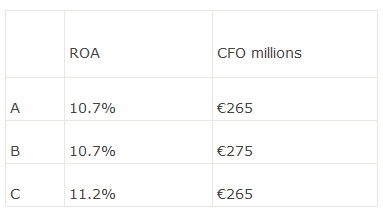

An analyst would like to compare Lazlo to a US-based telecommunications provider and has decided to adjust their financial statements to U.S.GAAP. under U.S.GAAP, and ignoring tax effects, the return on asset (ROA) and cash flow from operations (CFO) for Lazlo would be closestto:

第10题

(d) Player trading

Another proposal is for the club to sell its two valuable players, Aldo and Steel. It is thought that it will receive a

total of $16 million for both players. The players are to be offered for sale at the end of the current football season

on 1 May 2007. (5 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

赏学吧

赏学吧

微信搜一搜

微信搜一搜

赏学吧

赏学吧