The risk premium on corporate bonds becomes smaller as the liquidity of the bonds falls.()

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“The risk premium on corporate …”相关的问题

更多“The risk premium on corporate …”相关的问题

第1题

A.12%

B.8%

C.10%

D.6%

E.4%

第2题

A.charged

B.covered

C.insured

D.arranged

第3题

A.insured

B.covered

C.charged

D.arranged

第4题

A.average

B.general

C.extraneous

D.basic

第5题

A. Proactive planning enhances customer satisfaction

B. Solution differentiation from the competition allows for premium margins

C. Thereare faster implementation of new business applications

D. There is less risk through the implementation of proven solutions

第6题

A. There is faster implementation of new business applications.

B. Solution differentiation from the competition allows for premium margins.

C. There is less risk through the implementation of proven solutions.

D. Proactive planning enhances customer satisfaction.

第7题

A)the capital gain yield over the period plus the inflation rate

B)the capital gain yield over the period plus the dividend yield

C)the current yield plus the dividend yield

D)the dividend yield plus the risk premium

第8题

A.a coupon bond selling at a discount to par as a result of market yields increasing after the bond was issued.

B.a zero-coupon bond.

C.a coupon bond selling at a premium to par.

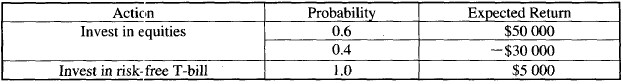

第9题

A.$20 000

B.$18 000

C.$15 000

D.$13 000

第10题

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

赏学吧

赏学吧

微信搜一搜

微信搜一搜

赏学吧

赏学吧