If the market rate is greater than the coupon rate, bonds will be sold at a premium.()

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“If the market rate is greater …”相关的问题

更多“If the market rate is greater …”相关的问题

第1题

第2题

第3题

A.bond rate

B.risk-adjusted rate

C.treasury bond interest

D.market rate

第4题

A.discount rate

B.contract rate

C.market rate

D.effective rate

第6题

The price in the foreign exchange market is called ______.

A.the trade surplus

B.the exchange rate

C.the money price

D.the currency rate

第7题

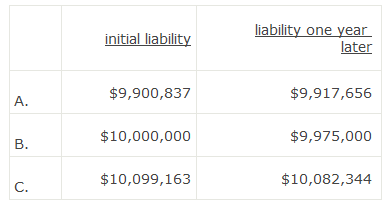

A company issues $10 million in 8% annual-pay, 5-year bonds, when the market rate is 8.25%.the initial balance sheet liability and liability one year from the date of issue are closest to:

第8题

Other information:

(i) The current market price of Mondglobe’s ordinary shares is 360 pence.

(ii) The annual volatility (variance) of Mondglobe’s shares for the last year was 169%.

(iii) The risk free rate is 4% per year.

(iv) No dividend is expected to be paid by Mondglobe during the next six months.

Required:

(a) Evaluate whether or not the price at which the investment bank is willing to sell the option is a fair price.(10 marks)

第9题

A. using the effective interest method results in a different interest expense each period.

B. The coupon interest rate is the market interest rate at the time the debt was issued.

C. A bond sells at a premium when the market interest rate exceeds the coupon rate.

第10题

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

赏学吧

赏学吧

微信搜一搜

微信搜一搜

赏学吧

赏学吧