At year-end, the perpetual inventory records of Anderson Co. indicate 60 units of a pa

A、$36,000.

B、$42,000.

C、$36,500.

D、$37,500.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

A、$36,000.

B、$42,000.

C、$36,500.

D、$37,500.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“At year-end, the perpetual inv…”相关的问题

更多“At year-end, the perpetual inv…”相关的问题

第1题

A.The year-end number of shares outstandin

B.The beginning of the year number of shares outstandin

C.The average of the beginning and the year-end number of shares outstandin

D.The weighted average of shares outstanding for the year.

第2题

A、¥1,600,000.

B、¥1,500,000.

C、¥6,300,000.

D、¥6,400,000.

第3题

A.A. To Use

B.B. using

C.C.Use

第4题

manager in charge of the audit of the financial statements of Indigo, for the year ending 31 December 2005.

Indigo owns office buildings, a workshop and a substantial stockyard on land that was leased in 1995 for 25 years.

Day-to-day operations are managed by the chief accountant, purchasing manager and workshop supervisor who

report to the managing director.

All iron, steel and other metals are purchased for cash at ‘scrap’ prices determined by the purchasing manager. Scrap

metal is mostly high volume. A weighbridge at the entrance to the stockyard weighs trucks and vans before and after

the scrap metals that they carry are unloaded into the stockyard.

Two furnaces in the workshop melt down the salvageable scrap metal into blocks the size of small bricks that are then

stored in the workshop. These are sold on both credit and cash terms. The furnaces are now 10 years old and have

an estimated useful life of a further 15 years. However, the furnace linings are replaced every four years. An annual

provision is made for 25% of the estimated cost of the next relining. A by-product of the operation of the furnaces is

the production of ‘clinker’. Most of this is sold, for cash, for road surfacing but some is illegally dumped.

Indigo’s operations are subsidised by the local authority as their existence encourages recycling and means that there

is less dumping of metal items. Indigo receives a subsidy calculated at 15% of the market value of metals purchased,

as declared in a quarterly return. The return for the quarter to 31 December 2005 is due to be submitted on

21 January 2006.

Indigo maintains manual inventory records by metal and estimated quality. Indigo counted inventory at 30 November

2005 with the intention of ‘rolling-forward’ the purchasing manager’s valuation as at that date to the year-end

quantities per the manual records. However, you were not aware of this until you visited Indigo yesterday to plan

your year-end procedures.

During yesterday’s tour of Indigo’s premises you saw that:

(i) sheets of aluminium were strewn across fields adjacent to the stockyard after a storm blew them away;

(ii) much of the vast quantity of iron piled up in the stockyard is rusty;

(iii) piles of copper and brass, that can be distinguished with a simple acid test, have been mixed up.

The count sheets show that metal quantities have increased, on average, by a third since last year; the quantity of

aluminium, however, is shown to be three times more. There is no suitably qualified metallurgical expert to value

inventory in the region in which Indigo operates.

The chief accountant disappeared on 1 December, taking the cash book and cash from three days’ sales with him.

The cash book was last posted to the general ledger as at 31 October 2005. The managing director has made an

allegation of fraud against the chief accountant to the police.

The auditor’s report on the financial statements for the year ended 31 December 2004 was unmodified.

Required:

(a) Describe the principal audit procedures to be carried out on the opening balances of the financial statements

of Indigo Co for the year ending 31 December 2005. (6 marks)

第5题

________a computer will help prepare year-end accounts.

A. Use

B. To use

C. Using

第6题

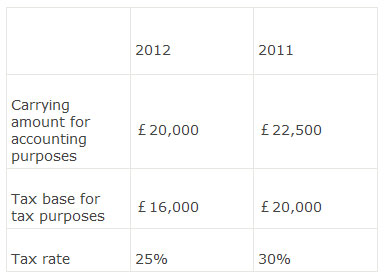

A company purchased equipment in 2011 for £25,000; the year-end values for accounting purposes and tax purposes are as follows:

Which of the following statements best describes the effect of the change in the tax rate on the company’s 2012 financial statements? The deferred tax liability:

A、Increased by £250

B、Decreased by £200

C、Decreased by £800

第7题

A.$65,000

B.$110,000

C.$140,000

D.$155,000

E.$185,000

第8题

A.A large lawsuit was filed against the company two daysafter the balance sheet dat

B.The company was nominated as Star Corporation by the nation

C.As of year-end, the chief executive officer had been hospitalized because of chest pains.

D.The company has experienced greater turnover rate that the previous years

第9题

A. $10,000.

B. $13,340.

C. $14,200.

第10题

Meeting Notice

To: All salesmen

Subject: The Year-end Sales Meeting From: Tracy, Secretary

The last sales meeting for 2018 will be 1) _______ on Monday, December 17th 9:00 a.m. 2) _______ 3:00 p.m. at the Head Office.

Lunch will be 3) ________.

The 4) _________ will be mailed by the end of November.

If you have any items to be included, please forward them to me by November 20th. If you are unable to 5) ________, please call 63419403, not later than November 30th.

Thank you.

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

赏学吧

赏学吧

微信搜一搜

微信搜一搜

赏学吧

赏学吧