(iii) Calculate the cash remaining in the company as a result of the salary and dividend p

(iii) Calculate the cash remaining in the company as a result of the salary and dividend payments made in

(ii) above. (1 mark)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

(iii) Calculate the cash remaining in the company as a result of the salary and dividend payments made in

(ii) above. (1 mark)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“(iii) Calculate the cash remai…”相关的问题

更多“(iii) Calculate the cash remai…”相关的问题

第1题

(i) The product mix ratio

(ii) Contribution to sales ratio for each product

(iii) General fixed costs

(iv) Method of apportioning general fixed costs

Which of the above are required in order to calculate the break-even sales revenue for the company?

A.All of the above

B.(i), (ii) and (iii) only

C.(i), (iii) and (iv) only

D.(ii) and (iii) only

第2题

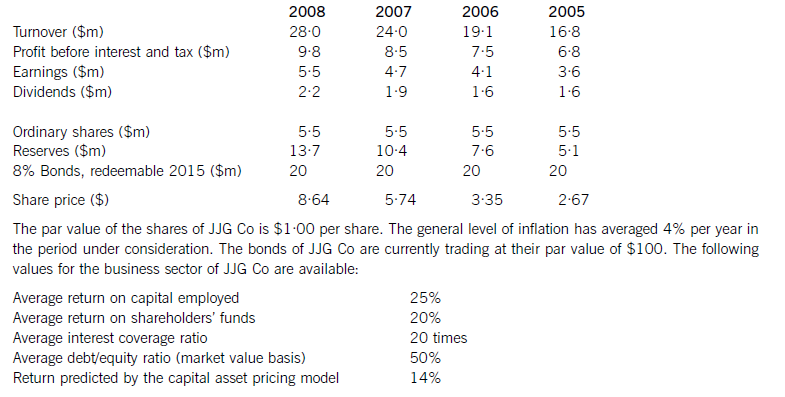

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

第3题

Heat Co is now trying to ascertain the best pricing policy that they should adopt for the Energy Buster’s launch onto the market. Demand is very responsive to price changes and research has established that, for every $15 increase in price, demand would be expected to fall by 1,000 units. If the company set the price at $735, only 1,000 units would be demanded.

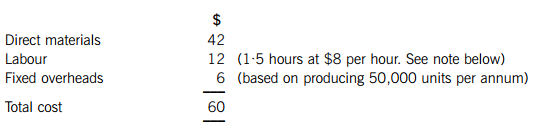

The costs of producing each air conditioning unit are as follows:

Note

The first air conditioning unit took 1·5 hours to make and labour cost $8 per hour. A 95% learning curve exists, in relation to production of the unit, although the learning curve is expected to finish after making 100 units. Heat Co’s management have said that any pricing decisions about the Energy Buster should be based on the time it takes to make the 100th unit of the product. You have been told that the learning co-efficient, b = –0·0740005.

All other costs are expected to remain the same up to the maximum demand levels.

Required:

(a) (i) Establish the demand function (equation) for air conditioning units; (3 marks)

(ii) Calculate the marginal cost for each air conditioning unit after adjusting the labour cost as required by the note above; (6 marks)

(iii) Equate marginal cost and marginal revenue in order to calculate the optimum price and quantity. (3 marks)

(b) Explain what is meant by a ‘penetration pricing’ strategy and a ‘market skimming’ strategy and discuss whether either strategy might be suitable for Heat Co when launching the Energy Buster. (8 marks)

第4题

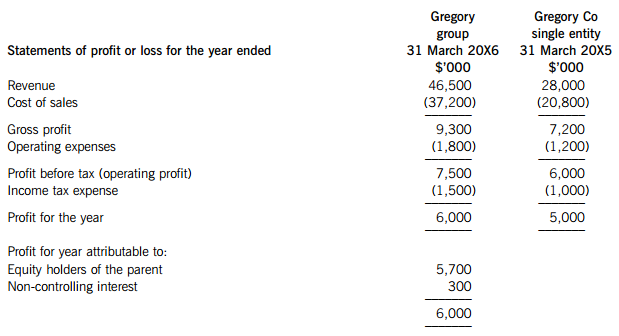

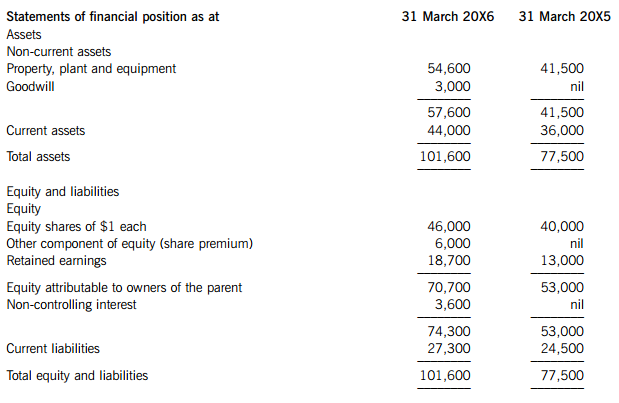

The summarised financial statements of Gregory Co as a single entity at 31 March 20X5 and as a group at 31 March 20X6 are:

Other information:

(i) Each month since the acquisition, Gregory Co’s sales to Tamsin Co were consistently $2m. Gregory Co had chosen to only make a gross profit margin of 10% on these sales as Tamsin Co is part of the group.

(ii) The values of property, plant and equipment held by both companies have been rising for several years.

(iii) On reviewing the above financial statements, Gregory Co’s chief executive officer (CEO) made the following observations:

(1) I see the profit for the year has increased by $1m which is up 20% on last year, but I thought it would be more as Tamsin Co was supposed to be a very profitable company.

(2) I have calculated the earnings per share (EPS) for 20X6 at 13 cents (6,000/46,000 x 100) and for 20X5 at 12·5 cents (5,000/40,000 x 100) and, although the profit has increased 20%, our EPS has barely changed.

(3) I am worried that the low price at which we are selling goods to Tamsin Co is undermining our group’s overall profitability.

(4) I note that our share price is now $2·30, how does this compare with our share price immediately before we bought Tamsin Co?

Required: (a) Reply to the four observations of the CEO. (8 marks)

(b) Using the above financial statements, calculate the following ratios for Gregory Co for the years ended 31 March 20X6 and 20X5 and comment on the comparative performance:

(i) Return on capital employed (ROCE)

(ii) Net asset turnover

(iii) Gross profit margin

(iv) Operating profit margin

Note: Four marks are available for the ratio calculations. (12 marks)

Note: Your answers to (a) and (b) should reflect the impact of the consolidation of Tamsin Co during the year ended 31 March 20X6.

第5题

Initial investment $2 million

Selling price (current price terms) $20 per unit

Expected selling price inflation 3% per year

Variable operating costs (current price terms) $8 per unit

Fixed operating costs (current price terms) $170,000 per year

Expected operating cost inflation 4% per year

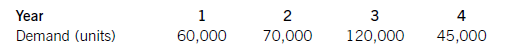

The research and development division has prepared the following demand forecast as a result of its test marketing trials. The forecast reflects expected technological change and its effect on the anticipated life-cycle of Product W33.

It is expected that all units of Product W33 produced will be sold, in line with the company’s policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product W33 is planned to end. For investment appraisal purposes, PV Co uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 30% per year. Ignore taxation.

Required:

(a) Identify and explain the key stages in the capital investment decision-making process, and the role of

investment appraisal in this process. (7 marks)

(b) Calculate the following values for the investment proposal:

(i) net present value;

(ii) internal rate of return;

(iii) return on capital employed (accounting rate of return) based on average investment; and

(iv) discounted payback period. (13 marks)

(c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. (5 marks)

第7题

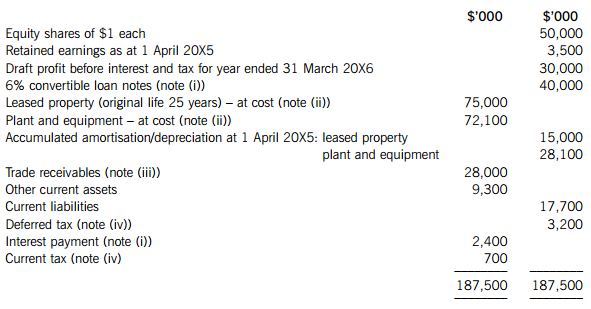

After preparing a draft statement of profit or loss (before interest and tax) for the year ended 31 March 20X6 (before any adjustments which may be required by notes (i) to (iv) below), the summarised trial balance of Triage Co as at 31 March 20X6 is:

The following notes are relevant:

(i) Triage Co issued 400,000 $100 6% convertible loan notes on 1 April 20X5. Interest is payable annually in arrears on 31 March each year. The loans can be converted to equity shares on the basis of 20 shares for each $100 loan note on 31 March 20X8 or redeemed at par for cash on the same date. An equivalent loan without the conversion rights would have required an interest rate of 8%.

The present value of $1 receivable at the end of each year, based on discount rates of 6% and 8%, are:

(ii) Non-current assets:

The directors decided to revalue the leased property at $66·3m on 1 October 20X5. Triage Co does not make an annual transfer from the revaluation surplus to retained earnings to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability at the company’s tax rate of 20%.

The leased property is depreciated on a straight-line basis and plant and equipment at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current assets for the year ended 31 March 20X6.

(iii) In September 20X5, the directors of Triage Co discovered a fraud. In total, $700,000 which had been included as receivables in the above trial balance had been stolen by an employee. $450,000 of this related to the year ended 31 March 20X5, the rest to the current year. The directors are hopeful that 50% of the losses can be recovered from the company’s insurers.

(iv) A provision of $2·7m is required for current income tax on the profit of the year to 31 March 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), at 31 March 20X6, the carrying amounts of Triage Co’s net assets are $12m more than their tax base.

Required:

(a) Prepare a schedule of adjustments required to the draft profit before interest and tax (in the above trial balance) to give the profit or loss of Triage Co for the year ended 31 March 20X6 as a result of the information in notes (i) to (iv) above.

(b) Prepare the statement of financial position of Triage Co as at 31 March 20X6.

(c) The issue of convertible loan notes can potentially dilute the basic earnings per share (EPS). Calculate the diluted earnings per share for Triage Co for the year ended 31 March 20X6 (there is no need to calculate the basic EPS).

Note: A statement of changes in equity and the notes to the statement of financial position are not required.

The following mark allocation is provided as guidance for this question:

(a) 5 marks

(b) 12 marks

(c) 3 marks

第8题

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

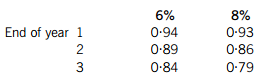

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

第10题

2 The Information Technology division (IT) of the RJ Business Consulting Group provides consulting services to its

clients as well as to other divisions within the group. Consultants always work in teams of two on every consulting

day. Each consulting day is charged to external clients at £750 which represents cost plus 150% profit mark up. The

total cost per consulting day has been estimated as being 80% variable and 20% fixed.

The director of the Human Resources (HR) division of RJ Business Consulting Group has requested the services of

two teams of consultants from the IT division on five days per week for a period of 48 weeks, and has suggested that

she meets with the director of the IT division in order to negotiate a transfer price. The director of the IT division has

responded by stating that he is aware of the limitations of using negotiated transfer prices and intends to charge the

HR division £750 per consulting day.

The IT division always uses ‘state of the art’ video-conferencing equipment on all internal consultations which would

reduce the variable costs by £50 per consulting day. Note: this equipment can only be used when providing internal

consultations.

Required:

(a) Calculate and discuss the transfer prices per consulting day at which the IT division should provide

consulting services to the HR division in order to ensure that the profit of the RJ Business Consulting Group

is maximised in each of the following situations:

(i) Every pair of consultants in the IT division is 100% utilised during the required 48-week period in

providing consulting services to external clients, i.e. there is no spare capacity.

(ii) There is one team of consultants who, being free from other commitments, would be available to

undertake the provision of services to the HR division during the required 48-week period. All other

teams of consultants would be 100% utilised in providing consulting services to external clients.

(iii) A major client has offered to pay the IT division £264,000 for the services of two teams of consultants

during the required 48-week period.

(12 marks)

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

赏学吧

赏学吧

微信搜一搜

微信搜一搜

赏学吧

赏学吧