Gregory Co is a listed company and, until 1 October 20X5, it had no subsidiaries. On that

date, it acquired 75% of Tamsin Co’s equity shares by means of a share exchange of two new shares in Gregory Co for every five acquired shares in Tamsin Co. These shares were recorded at the market price on the day of the acquisition and were the only shares issued by Gregory Co during the year ended 31 March 20X6.

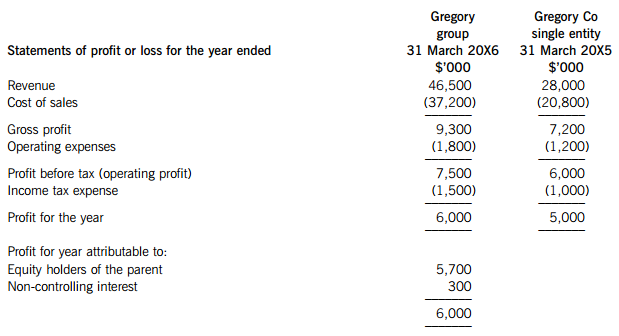

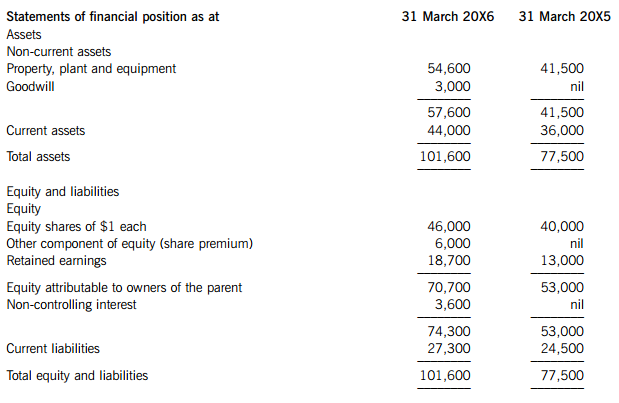

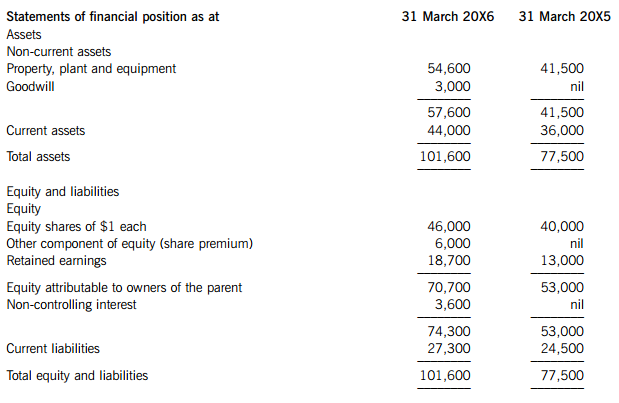

The summarised financial statements of Gregory Co as a single entity at 31 March 20X5 and as a group at 31 March 20X6 are:

Other information:

(i) Each month since the acquisition, Gregory Co’s sales to Tamsin Co were consistently $2m. Gregory Co had chosen to only make a gross profit margin of 10% on these sales as Tamsin Co is part of the group.

(ii) The values of property, plant and equipment held by both companies have been rising for several years.

(iii) On reviewing the above financial statements, Gregory Co’s chief executive officer (CEO) made the following observations:

(1) I see the profit for the year has increased by $1m which is up 20% on last year, but I thought it would be more as Tamsin Co was supposed to be a very profitable company.

(2) I have calculated the earnings per share (EPS) for 20X6 at 13 cents (6,000/46,000 x 100) and for 20X5 at 12·5 cents (5,000/40,000 x 100) and, although the profit has increased 20%, our EPS has barely changed.

(3) I am worried that the low price at which we are selling goods to Tamsin Co is undermining our group’s overall profitability.

(4) I note that our share price is now $2·30, how does this compare with our share price immediately before we bought Tamsin Co?

Required: (a) Reply to the four observations of the CEO. (8 marks)

(b) Using the above financial statements, calculate the following ratios for Gregory Co for the years ended 31 March 20X6 and 20X5 and comment on the comparative performance:

(i) Return on capital employed (ROCE)

(ii) Net asset turnover

(iii) Gross profit margin

(iv) Operating profit margin

Note: Four marks are available for the ratio calculations. (12 marks)

Note: Your answers to (a) and (b) should reflect the impact of the consolidation of Tamsin Co during the year ended 31 March 20X6.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案