Corporate debt securities that are offered continuously to investors by an agent of t

A. medium-term notes.

B. structured notes.

C. range notes.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

A. medium-term notes.

B. structured notes.

C. range notes.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“Corporate debt securities that…”相关的问题

更多“Corporate debt securities that…”相关的问题

第1题

An analyst reviews a corporate bond indenture that contains these two covenants:

1) The borrower will pay interest semi-annually

and principal at maturity.

2) The borrower will not incur additional debt if its debt/capital ratio is more than 50%.

What types of covenants are these?

A. Both are affirmative covenants.

B. Covenant 1 is negative and Covenant 2 is affirmative.

C. Covenant 2 is negative and Covenant 1 is affirmative.

第2题

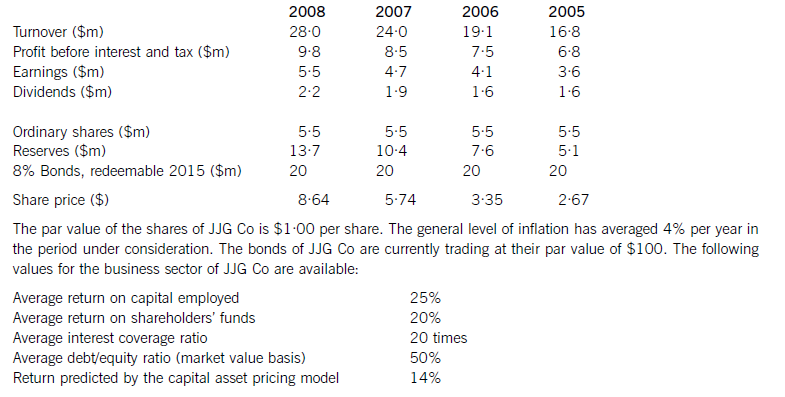

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

第3题

在题干所给出的smb.conf配置文件中,Samba用户密码存放在哪个文件中?

在smb.conf配置文件中,security语句用于定义Samba服务器的安全级别,有share、user、server、 domain等4种常用级别。如果允许任何网络用户都可以匿名方式访问Samba服务器上的共享资源,那么 smb.conf文件中(7)空缺处应填入哪个配置参数?

第4题

Why Companies Now Favour Cash

A.Cheap and plentiful credit has powered the US economy for decades. But since the fi- nancial crisis of 2008, America has gone on a drastic debt diet. Just as families are pay- ing down credit-card debt and building up cash reserves, businesses large and small are learning to operate in an environment where cash once again is king. The economic shift has been dramatic; bank lending has dropped at a frightening rate. In 2009 the banking system notched (刻数) the largest decline in loans in the history of the Federal Deposit Insurance Corporation. Meanwhile, the amount of commercial and industrial loans has fallen 19 percent since the fall of 2008 —— back to the level of late 2006. Even the finan- cial sector has cut way back on debt.

B.Sorry about credit bubble, both companies and individuals spent and invested based on expectations of what they could borrow. Now they"re hoarding cash. The savings rate, near zero in 2007, rose to 3.3 percent in January. At the end of the September in 2009, the 376 members of the S&P 500 that aren"t utilities or financial firms had a record $820 billion in cash in their coffers (金库), up more than 20 percent from the year be- fore, according to Standard & Poor"s.

C.The conventional wisdom holds that the tightening of credit is an obstacle to recovery. And for many businesses, especially small ones, the inability to pay off old debt or open new lines of credit can hinder expansion plans. But the economy isn"t fueled by debt alone. After all, in 2009, the economy experienced a sharp turn, from shrinking at a rate of 6.4 percent in the first quarter to growing at a rate of 5.9 percent in the fourth quarter —— all while private- sector credit reduced. More broadly, the embrace of cash could be beneficial. During the go- go years, it was common to hear theorists talk about the "discipline of debt".

D.On paper, high debt loads force managers (and homeowners) to make tough, swift decisions to stay solvent (有偿付能力的). Break the contact, and you lose the company (or the house). In reality, overextended (周转不灵的) borrowers are more likely to walk away from mortgages, or push companies into Chapter 11 bankruptcy protection. Amer- icans are now discovering that cash exerts a superior discipline. The real discipline of cash may be that it causes executives, consumers, and investors to think twice —— and to think about the long-term consequences —— before spending. The need for instant satis- faction is part of what created the current mess.

E. The ability to adapt rapidly remains one of America"s competitive advantages. And since the onset of the financial crisis, both consumers and businesses have embraced the new real- ity. After digging themselves out of $20,000 in debt in 2007, Susarmah Fater, her husband David —— a district manager at Staples —— and their four children did something radical: they became an all-cash household. "Bills like groceries, gas, and allowance are taken out every month and put into envelopes so that we know exactly where we are financially," says Su- sannah. Consumer-oriented firms have pivoted (以……为中心旋转) rapidly to service new pay-as-you-go consumers like the Faters. ELayaway.com, based in Tallahassee, Fla., and founded in 2005, offers its 75,000 customers the ability to buy products on installment plans (up to 13 months) from 1,000 merchants, including Apple and Amazon.com. The typical purchase is an electronics item with an average cost of $440 and a four-month payment term.

Cofounder Sergio Pinon notes the rise of a category of customers eLayaway calls "planners",who pay for next winter"s snowblowers this summer.

F. Texas electricity provider First Choice Power in January launched a prepaid service called Control First. "In Texas, there are about a million households who have slim credit or no credit at all," says company president Brian Hayduk. Without requiring a deposit or credit, customers are permitted to prepurchase a set amount of electricity —— say $100 per month.

The company installs a smart meter that lets people know how much they"ve used —— which spurs customers to manage their energy use more intelligently.

G. The rise of the cash economy has made businesses hesitant to make the type of capital expenditures they used to fund with debt —— big-ticket items like factories, expensive equipment, and new buildings. But it has made them more receptive to companies that offer efficiency and saving with little money down. At Boston-based EnerNOC, reve- nues nearly doubled last year. EnerNOC has two lines of business. On behalf of electric utilities, they supports companies that agree to reduce electricity use at times of peak demand in exchange for cash payments. And it installs submeters to measure buildings" energy consumption in microscopic detail, and then suggests ways to reduce demand.

"We sell the software and guarantee we"ll identify energy-savings opportunities worth twice what they pay us on an annual basis," says CEO Tim Healy. "It"s very capital- light." In 2009 the number of company employees rose from about 330 to more than 400, and it projected revenue growth of $75 million (nearly 40 percent) in 2010.

H. Before the deluge, companies and investors chose the easy path of gaining returns by us- ing their balance sheet —— they"d borrow money to pay a dividend, or to purchase another company. But financial engineering has given way to business engineering. Kohlberg Kravis & Roberts, the huge leveraged-buyout firm that made profits through financial strategies during the credit boom, has built up a staff of in-house retail executives who work with com- panies" it owns, such as Dollar General and Toys "R" Us. Just as there are fewer no-money- down mortgages in the housing market, many of today"s buyouts are significantly less lever- aged. Since transactions that use less debt and more cash are less likely to go bankrupt, the greater use of cash is a basis for a more stable, more rational financial system. Stephen Ka- plan, a professor at the University of Chicago business school, notes that returns are poor for buyout fimds that make highly leveraged acquisitions during credit booms. When cheap debt is available on easy terms, "they do more marginal deals."

I. Of course, a fine line separates conservation from hoarding, and careful saving from miserliness (吝啬). For many financial executives, the wholesale collapse of the credit markets in the fall of 2008 induced the same reaction that the anti-drug movie Scared Straight used to create among teenagers. "There"s a greater focus on liquidity and the preservation of cash for the unexpected than you had in the past," says Seth Gardner, executive director of the Centre for Financial Excellence at Duke University"s Fuqua School of Business. Yet there are signs that corporate America is beginning to loosen the purse strings. Investment in equipment and software rebounded at an 18.4 percent an- nual rate in the fourth quarter of 2009. And S&P analyst Howard Silverblatt predicts that companies will start utilising their record cash piles on stock buybacks, dividends, and capital expenditures once they"re convinced the recovery is real.

People‘s traditional idea about the credit is that the tightening of it prevents the eco-nomic recovery.

查看材料

第7题

第10题

Larger size debt issues normally have:

A. greater yield spread.

B. the same yield spread with smaller size debt issues.

C. lower yield spread.

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

赏学吧

赏学吧

微信搜一搜

微信搜一搜

赏学吧

赏学吧