As per Question 1 in Exercise 3, if drawee: The Importing Co., Melbourne refuses to accept the draft

Acceptor for honour

of ①______

on ②______

signed by ③______

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

Acceptor for honour

of ①______

on ②______

signed by ③______

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“As per Question 1 in Exercise …”相关的问题

更多“As per Question 1 in Exercise …”相关的问题

第1题

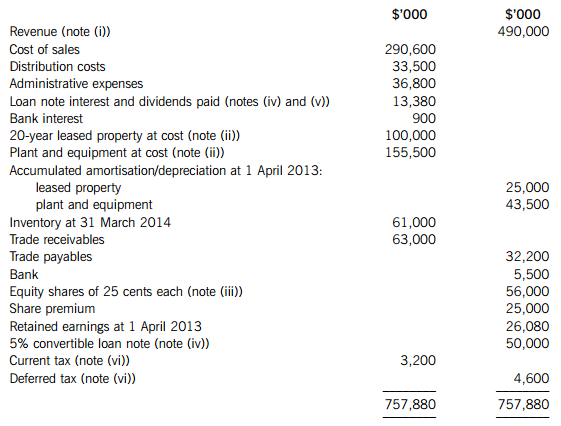

The following trial balance relates to Xtol at 31 March 2014:

The following notes are relevant:

(i) Revenue includes an amount of $20 million for cash sales made through Xtol’s retail outlets during the year on behalf of Francais. Xtol, acting as agent, is entitled to a commission of 10% of the selling price of these goods. By 31 March 2014, Xtol had remitted to Francais $15 million (of the $20 million sales) and recorded this amount in cost of sales.

(ii) Plant and equipment is depreciated at 12?% per annum on the reducing balance basis. All amortisation/depreciation of non-current assets is charged to cost of sales.

(iii) On 1 August 2013, Xtol made a fully subscribed rights issue of equity share capital based on two new shares at 60 cents each for every five shares held. The market price of Xtol’s shares before the issue was $1·02 each. The issue has been fully recorded in the trial balance figures.

(iv) On 1 April 2013, Xtol issued a 5% $50 million convertible loan note at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par or convertible into equity shares at the option of the loan note holders on 31 March 2016.

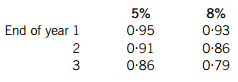

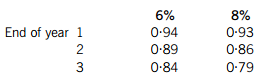

The interest on an equivalent loan note without the conversion rights would be 8% per annum. The present values of $1 receivable at the end of each year, based on discount rates of 5% and 8%, are:

(v) An equity dividend of 4 cents per share was paid on 30 May 2013 and, after the rights issue, a further dividend of 2 cents per share was paid on 30 November 2013.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2013. A provision of $28 million is required for current tax for the year ended 31 March 2014 and at this date the deferred tax liability was assessed at $8·3 million.

Required:

(a) Prepare the statement of profit or loss for Xtol for the year ended 31 March 2014.

(b) Prepare the statement of changes in equity for Xtol for the year ended 31 March 2014.

(c) Prepare the statement of financial position for Xtol as at 31 March 2014.

(d) Calculate the basic earnings per share (EPS) for Xtol for the year ended 31 March 2014.

Note: Answers and workings (for parts (a) to (c)) should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 8 marks

(b) 6 marks

(c) 8 marks

(d) 3 marks

第2题

Question : Should the Chinese company compensate the American trader for the loss? Why?

第3题

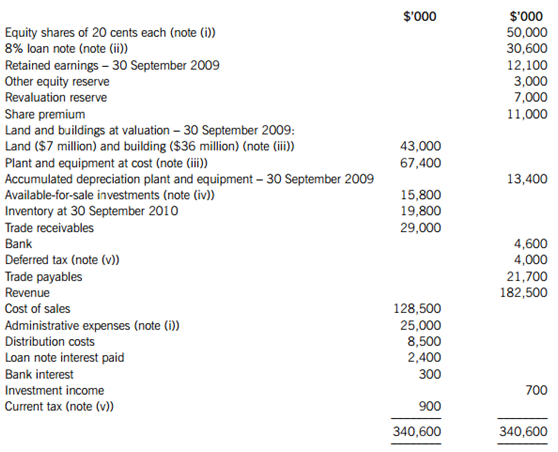

The following trial balance relates to Cavern as at 30 September 2010:

The following notes are relevant:

(i) Cavern has accounted for a fully subscribed rights issue of equity shares made on 1 April 2010 of one new share for every four in issue at 42 cents each. The company paid ordinary dividends of 3 cents per share on 30 November 2009 and 5 cents per share on 31 May 2010. The dividend payments are included in administrative expenses in the trial balance.

(ii) The 8% loan note was issued on 1 October 2008 at its nominal (face) value of $30 million. The loan note will be redeemed on 30 September 2012 at a premium which gives the loan note an effective fi nance cost of 10% per annum.

(iii) Non-current assets:

Cavern revalues its land and building at the end of each accounting year. At 30 September 2010 the relevant value to be incorporated into the fi nancial statements is $41·8 million. The building’s remaining life at the beginning of the current year (1 October 2009) was 18 years. Cavern does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation surplus. Ignore deferred tax on the revaluation surplus.

Plant and equipment includes an item of plant bought for $10 million on 1 October 2009 that will have a 10-year life (using straight-line depreciation with no residual value). Production using this plant involves toxic chemicals which will cause decontamination costs to be incurred at the end of its life. The present value of these costs using a discount rate of 10% at 1 October 2009 was $4 million. Cavern has not provided any amount for this future decontamination cost. All other plant and equipment is depreciated at 12·5% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2010. All depreciation is charged to cost of sales.

(iv) The available-for-sale investments held at 30 September 2010 had a fair value of $13·5 million. There were no acquisitions or disposals of these investments during the year ended 30 September 2010.

(v) A provision for income tax for the year ended 30 September 2010 of $5·6 million is required. The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2009. At 30 September 2010 the tax base of Cavern’s net assets was $15 million less than their carrying amounts. The movement on deferred tax should be taken to the income statement. The income tax rate of Cavern is 25%.

Required:

(a) Prepare the statement of comprehensive income for Cavern for the year ended 30 September 2010.

(b) Prepare the statement of changes in equity for Cavern for the year ended 30 September 2010.

(c) Prepare the statement of fi nancial position of Cavern as at 30 September 2010.

Notes to the fi nancial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 11 marks

(b) 5 marks

(c) 9 marks

第4题

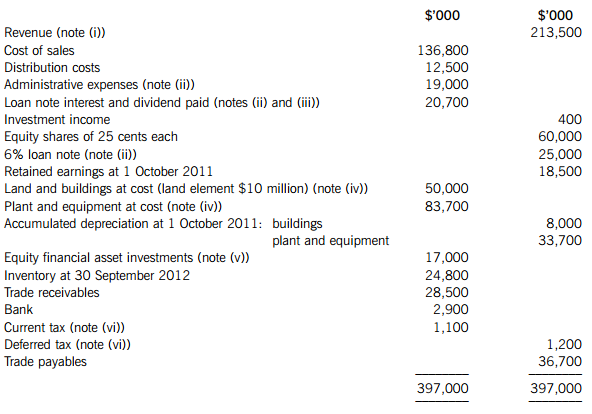

The following trial balance relates to Quincy as at 30 September 2012:

The following notes are relevant:

(i) On 1 October 2011, Quincy sold one of its products for $10 million (included in revenue in the trial balance). As part of the sale agreement, Quincy is committed to the ongoing servicing of this product until 30 September 2014 (i.e. three years from the date of sale). The value of this service has been included in the selling price of $10 million. The estimated cost to Quincy of the servicing is $600,000 per annum and Quincy’s normal gross profit margin on this type of servicing is 25%. Ignore discounting.

(ii) Quincy issued a $25 million 6% loan note on 1 October 2011. Issue costs were $1 million and these have been charged to administrative expenses. The loan will be redeemed on 30 September 2014 at a premium which gives an effective interest rate on the loan of 8%.

(iii) Quincy paid an equity dividend of 8 cents per share during the year ended 30 September 2012.

(iv) Non-current assets:

Quincy had been carrying land and buildings at depreciated cost, but due to a recent rise in property prices, it decided to revalue its property on 1 October 2011 to market value. An independent valuer confirmed the value of the property at $60 million (land element $12 million) as at that date and the directors accepted this valuation. The property had a remaining life of 16 years at the date of its revaluation. Quincy will make a transfer from the revaluation reserve to retained earnings in respect of the realisation of the revaluation reserve. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 September 2012. All depreciation is charged to cost of sales.

(v) The investments had a fair value of $15·7 million as at 30 September 2012. There were no acquisitions or disposals of these investments during the year ended 30 September 2012.

(vi) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2011. A provision for income tax for the year ended 30 September 2012 of $7·4 million is required. At 30 September 2012, Quincy had taxable temporary differences of $5 million, requiring a provision for deferred tax. Any deferred tax adjustment should be reported in the income statement. The income tax rate of Quincy is 20%.

Required:

(a) Prepare the statement of comprehensive income for Quincy for the year ended 30 September 2012.

(b) Prepare the statement of changes in equity for Quincy for the year ended 30 September 2012.

(c) Prepare the statement of financial position for Quincy as at 30 September 2012. Notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(a) 11 marks

(b) 4 marks

(c) 10 marks

第5题

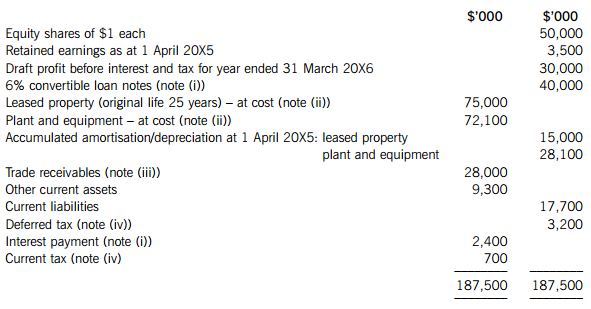

After preparing a draft statement of profit or loss (before interest and tax) for the year ended 31 March 20X6 (before any adjustments which may be required by notes (i) to (iv) below), the summarised trial balance of Triage Co as at 31 March 20X6 is:

The following notes are relevant:

(i) Triage Co issued 400,000 $100 6% convertible loan notes on 1 April 20X5. Interest is payable annually in arrears on 31 March each year. The loans can be converted to equity shares on the basis of 20 shares for each $100 loan note on 31 March 20X8 or redeemed at par for cash on the same date. An equivalent loan without the conversion rights would have required an interest rate of 8%.

The present value of $1 receivable at the end of each year, based on discount rates of 6% and 8%, are:

(ii) Non-current assets:

The directors decided to revalue the leased property at $66·3m on 1 October 20X5. Triage Co does not make an annual transfer from the revaluation surplus to retained earnings to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability at the company’s tax rate of 20%.

The leased property is depreciated on a straight-line basis and plant and equipment at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current assets for the year ended 31 March 20X6.

(iii) In September 20X5, the directors of Triage Co discovered a fraud. In total, $700,000 which had been included as receivables in the above trial balance had been stolen by an employee. $450,000 of this related to the year ended 31 March 20X5, the rest to the current year. The directors are hopeful that 50% of the losses can be recovered from the company’s insurers.

(iv) A provision of $2·7m is required for current income tax on the profit of the year to 31 March 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), at 31 March 20X6, the carrying amounts of Triage Co’s net assets are $12m more than their tax base.

Required:

(a) Prepare a schedule of adjustments required to the draft profit before interest and tax (in the above trial balance) to give the profit or loss of Triage Co for the year ended 31 March 20X6 as a result of the information in notes (i) to (iv) above.

(b) Prepare the statement of financial position of Triage Co as at 31 March 20X6.

(c) The issue of convertible loan notes can potentially dilute the basic earnings per share (EPS). Calculate the diluted earnings per share for Triage Co for the year ended 31 March 20X6 (there is no need to calculate the basic EPS).

Note: A statement of changes in equity and the notes to the statement of financial position are not required.

The following mark allocation is provided as guidance for this question:

(a) 5 marks

(b) 12 marks

(c) 3 marks

第6题

When this happens, the average and professional investors alike tend to overlook the company because they become familiar with the trading range.

Take, for example, Wal-Mart. Over the past five years, the retailing behemoth has grown sales by over 80%, profits by over 100%, and yet the stock price has fallen as much as 30% during that timeframe. Clearly, the valuation picture has changed. An investor that read the annual report back in 2000 or 2001 might have passed on the security, deeming it too expensive based on a metric such as the price to earnings ratio. Today, however, the equation is completely different--despite the stock price, WalMart is, in essence, trading at half its former price because each share is backed by a larger dividend, twice the earnings power, more stores, and a bigger infrastructure. Home Depot is in much the same boat, largely because some Wall Street analysts question how fast two of the world's largest companies can continue

to grow before their sheer size slows them down to the rate of the general economy.

Coca-Cola is another excellent example of this phenomenon. Ten years ago, in 1996, the stock traded between a range of $ 36.10 and $ 54.30 per share. At the time, it had reported earnings per share of $1.40 and paid a cash dividend of $ 0.50 per share. Corporate per share book value was $ 2.48.Last year, the stock traded within a range of $ 40.30 and $ 45.30 per share; squarely in the middle of the same area it had been nearly a decade prior! Yet, despite the stagnant stock price, the 2006 estimates Value Line Investment Survey estimates for earnings per share stand around $ 2.16 (a rise of 54%), the cash dividend has more than doubled to $1.20, book value is expected to have grown to $ 7.40 per share (a gain of nearly 300%), and the total number of shares outstanding (未偿付的,未完成的)has actually decreased from 2.481 billion to an estimated 2.355 billion due to the company's share repurchase program.

16.This passage is probably a part of______.

A.Find Hidden Value in the Market B.Become Richer

C.Get Good Bargains D.Identify Good Companies

17.The italicized word “stagnant” (line 4, Para. 1)can be best paraphrased as______.

A.prominent B.terrible C.unchanged D.progressing

18.Wal-Mart is now trading at a much lower price because

A.it has stored a large quantity of goods

B.it has become financially more powerful

C.it has been eager to collect money to prevent bankruptcy

D.it is a good way to compete with other retailing companies

19.All the following are shared by Wal-Mart and Coco-Cola EXCEPT______.

A.the cash dividend has increased

B.the earning power has become stronger

C.both businesses have continued to grow

D.the stock price has greatly decreased

20.According to the author, one had better______.

A.buy more shares when the stock price falls down

B.sell out the shares when the stock price falls down

C.do some research on the value. of a business when its stock price falls down

D.invest in the business when its stock price fails down

第7题

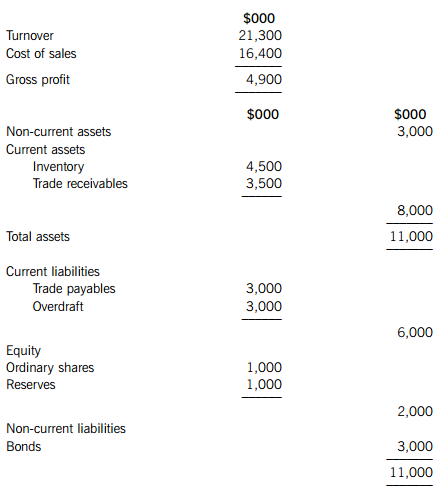

Extracts from the recent financial statements of Bold Co are given below.

A factor has offered to manage the trade receivables of Bold Co in a servicing and factor-financing agreement. The factor expects to reduce the average trade receivables period of Bold Co from its current level to 35 days; to reduce bad debts from 0·9% of turnover to 0·6% of turnover; and to save Bold Co $40,000 per year in administration costs. The factor would also make an advance to Bold Co of 80% of the revised book value of trade receivables. The interest rate on the advance would be 2% higher than the 7% that Bold Co currently pays on its overdraft. The factor would charge a fee of 0·75% of turnover on a with-recourse basis, or a fee of 1·25% of turnover on a non-recourse basis. Assume that there are 365 working days in each year and that all sales and supplies are on credit.

Required:

(a) Explain the meaning of the term ‘cash operating cycle’ and discuss the relationship between the cash operating cycle and the level of investment in working capital. Your answer should include a discussion of relevant working capital policy and the nature of business operations. (7 marks)

(b) Calculate the cash operating cycle of Bold Co. (Ignore the factor’s offer in this part of the question). (4 marks)

(c) Calculate the value of the factor’s offer:

(i) on a with-recourse basis;

(ii) on a non-recourse basis. (7 marks)

(d) Comment on the financial acceptability of the factor’s offer and discuss the possible benefits to Bold Co of factoring its trade receivables. (7 marks)

第8题

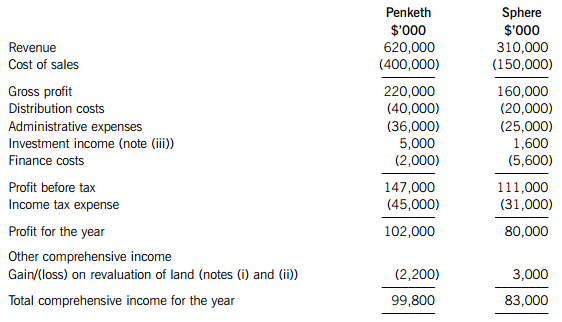

The retained earnings of Sphere brought forward at 1 April 2013 were $120 million.

The summarised statements of profit or loss and other comprehensive income for the companies for the year ended 31 March 2014 are:

The following information is relevant:

(i) A fair value exercise conducted on 1 October 2013 concluded that the carrying amounts of Sphere’s net assets were equal to their fair values with the following exceptions:

– the fair value of Sphere’s land was $2 million in excess of its carrying amount

– an item of plant had a fair value of $6 million in excess of its carrying amount. The plant had a remaining life of two years at the date of acquisition. Plant depreciation is charged to cost of sales.

– Penketh placed a value of $5 million on Sphere’s good trading relationships with its customers. Penketh expected, on average, a customer relationship to last for a further five years. Amortisation of intangible assets is charged to administrative expenses.

(ii) Penketh’s group policy is to revalue land to market value at the end of each accounting period. Prior to its acquisition, Sphere’s land had been valued at historical cost, but it has adopted the group policy since its acquisition. In addition to the fair value increase in Sphere’s land of $2 million (see note (i)), it had increased by a further $1 million since the acquisition.

(iii) On 1 October 2013, Penketh also acquired 30% of Ventor’s equity shares. Ventor’s profit after tax for the year ended 31 March 2014 was $10 million and during March 2014 Ventor paid a dividend of $6 million. Penketh uses equity accounting in its consolidated financial statements for its investment in Ventor.

Sphere did not pay any dividends in the year ended 31 March 2014.

(iv) After the acquisition Penketh sold goods to Sphere for $20 million. Sphere had one fifth of these goods still in inventory at 31 March 2014. In March 2014 Penketh sold goods to Ventor for $15 million, all of which were still in inventory at 31 March 2014. All sales to Sphere and Ventor had a mark-up on cost of 25%.

(v) Penketh’s policy is to value the non-controlling interest at the date of acquisition at its fair value. For this purpose, the share price of Sphere at that date (1 October 2013) is representative of the fair value of the shares held by the non-controlling interest.

(vi) All items in the above statements of profit or loss and other comprehensive income are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) Calculate the consolidated goodwill as at 1 October 2013.

(b) Prepare the consolidated statement of profit or loss and other comprehensive income of Penketh for the year ended 31 March 2014.

The following mark allocation is provided as guidance for this question:

(a) 6 marks

(b) 19 marks

第9题

1.According to this passage, the answer to the question “Do you prefer coffee or tea? ” might in part be down to your genes.

1.A genetic predisposition to perceiving the bitterness of particular substances makes us always prefer to coffee.

1.The underlined word “prop” in Para. 3 refers to a small object such as a book, weapon etc, used by actors in a play or film.

1.People with an increased perception of the bitterness of caffeine drank a little more coffee.

1.The preference towards tea can be seen as a consequence of absorbing from coffee.

第10题

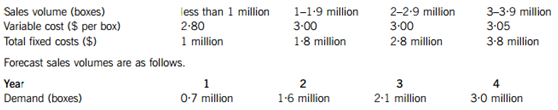

The production equipment for the new confectionery line would cost $2 million and an additional initial investment of $750,000 would be needed for working capital. Capital allowances (tax-allowable depreciation) on a 25% reducing balance basis could be claimed on the cost of equipment. Profit tax of 30% per year will be payable one year in arrears. A balancing allowance would be claimed in the fourth year of operation.

The average general level of inflation is expected to be 3% per year and selling price, variable costs, fixed costs and working capital would all experience inflation of this level. BRT Co uses a nominal after-tax cost of capital of 12% to appraise new investment projects.

Required:

(a) Assuming that production only lasts for four years, calculate the net present value of investing in the new product using a nominal terms approach and advise on its financial acceptability (work to the nearest $1,000). (13 marks)

(b) Comment briefly on the proposal to use a four-year time horizon, and calculate and discuss a value that could be placed on after-tax cash flows arising after the fourth year of operation, using a perpetuity approach. Assume, for this part of the question only, that before-tax cash flows and profit tax are constant from year five onwards, and that capital allowances and working capital can be ignored. (5 marks)

(c) Discuss THREE ways of incorporating risk into the investment appraisal process. (7 marks)

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

赏学吧

赏学吧

微信搜一搜

微信搜一搜

赏学吧

赏学吧