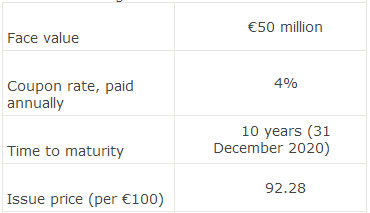

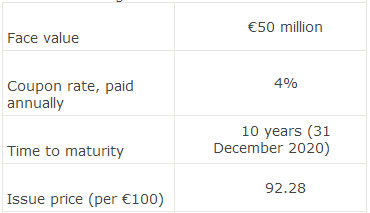

On 1 January 2011 the market rate of interest on a company’s bonds is 5% and it issue

If the company uses IFRS, its interest expense (in millions) in 2011 is closest to:

A.€1.846.

B.€2.307.

C.€2.386.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

If the company uses IFRS, its interest expense (in millions) in 2011 is closest to:

A.€1.846.

B.€2.307.

C.€2.386.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“On 1 January 2011 the market r…”相关的问题

更多“On 1 January 2011 the market r…”相关的问题

第1题

Issued on 1 January 2005, when the market rate of interest was 6%.

Bought back in an open market transaction on 1 January 2011, when the market rate of interest rate was 8%.

Which of the following statements best describes the effect of the bond repurchase on the financial statements for 2011? If the company uses the indirect method of calculating the cash from operations, there will be a:

A.$346,511 gain on the income statement.

B.$743,873 gain on the income statement.

C.$350,984 decrease in the cash from operations.

第2题

A. $420.

B. $2,820.

C. $6,720.

第3题

A.£4,695,562.

B.£5,301,000.

C.£5,316,000.

第4题

A.$48,000.

B.$51,000.

C.$53,125.

第5题

10. On 1 January 2009, a company that prepares its financial statements according to IFRS issued bonds with the following features:

·Face value £20,000,000

·Term 5 years

·Coupon rate 6% paid annually on December 31

·Market rate at issue 4%

The company did not elect to carry the bonds at fair value. In December 2011 the market rate on similar bonds had increased to 5% and the company decided to buy back (retire) the bonds after the coupon payment on December 31. As a result, the gain on retirement reported on the 2011 statement of income is closest to:

A. £340,410.

B. £371,882.

C. £382,556.

第6题

第7题

A.Ng Ka Ling and Another v. The Director of Immigration [1999] HKCFA 72; [1999] 1 HKLRD 315; (1999) 2 HKCFAR 4; [1999] 1 HKC 291 ; FACV 14/1998 (29 January 1999)

B.The Director of Immigration v. Chong Fung Yuen [2001] HKCFA 48; [2001] 2 HKLRD 533; (2001) 4 HKCFAR 211; FACV 26/2000 (20 July 2001)

C.Democratic Republic of the Congo and Others v. FG Hemisphere Associates LLC [2011] HKCFA 41; (2011) 14 HKCFAR 95; [2011] 4 HKC 151; FAC

第8题

A.Ng Ka Ling and Another v. The Director of Immigration [1999] HKCFA 72; [1999] 1 HKLRD 315; (1999) 2 HKCFAR 4; [1999] 1 HKC 291 ; FACV 14/1998 (29 January 1999)

B.The Director of Immigration v. Chong Fung Yuen [2001] HKCFA 48; [2001] 2 HKLRD 533; (2001) 4 HKCFAR 211; FACV 26/2000 (20 July 2001)

C.Democratic Republic of the Congo and Others v. FG Hemisphere Associates LLC [2011] HKCFA 41; (2011) 14 HKCFAR 95; [2011] 4 HKC 151; FAC

为了保护您的账号安全,请在“赏学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

赏学吧

赏学吧

微信搜一搜

微信搜一搜

赏学吧

赏学吧