The following scenario relates to questions 1–5.Aphrodite Co has a year end of 31 December

The following scenario relates to questions 1–5.

Aphrodite Co has a year end of 31 December and operates a factory which makes computer chips for mobile phones. It purchased a machine on 1 July 20X3 for $80,000 which had a useful life of ten years and is depreciated on the straight-line basis, time apportioned in the years of acquisition and disposal. The machine was revalued to $81,000 on 1 July 20X4. There was no change to its useful life at that date.

A fire at the factory on 1 October 20X6 damaged the machine leaving it with a lower operating capacity. The accountant considers that Aphrodite Co will need to recognise an impairment loss in relation to this damage. The accountant has ascertained the following information at 1 October 20X6:

(1) The carrying amount of the machine is $60,750.

(2) An equivalent new machine would cost $90,000.

(3) The machine could be sold in its current condition for a gross amount of $45,000. Dismantling costs would amount to $2,000.

(4) In its current condition, the machine could operate for three more years which gives it a value in use figure of $38,685.

In accordance with IAS 16 Property, Plant and Equipment, what is the depreciation charged to Aphrodite Co’s profit or loss in respect of the machine for the year ended 31 December 20X4?

A.$9,000

B.$8,000

C.$8,263

D.$8,500

What is the total impairment loss associated with Aphrodite Co’s machine at 1 October 20X6?A.$nil

B.$17,750

C.$22,065

D.$15,750

The accountant has decided that it is too difficult to reliably attribute cash flows to this one machine and that it would be more accurate to calculate the impairment on the basis of the factory as a cash-generating unit.

In accordance with IAS 36, which of the following is TRUE regarding cash generating units?

A.A cash-generating unit to which goodwill has been allocated should be tested for impairment every five years

B.A cash-generating unit must be a subsidiary of the parent

C.There is no need to consistently identify cash-generating units based on the same types of asset from period to period

D.A cash-generating unit is the smallest identifiable group of assets for which independent cash flows can be identified

On 1 July 20X7, it is discovered that the damage to the machine is worse than originally thought. The machine is now considered to be worthless and the recoverable amount of the factory as a cash-generating unit is estimated to be $950,000.

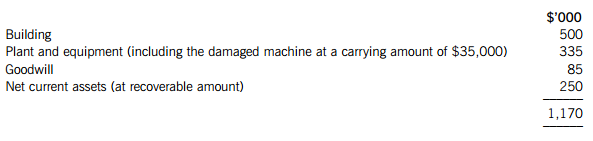

At 1 July 20X7, the cash-generating unit comprises the following assets:

In accordance with IAS 36, what will be the carrying amount of Aphrodite Co’s plant and equipment when the impairment loss has been allocated to the cash-generating unit?

A.$262,500

B.$300,000

C.$237,288

D.$280,838

IAS 36 Impairment of Assets contains a number of examples of internal and external events which may indicate the impairment of an asset.

In accordance with IAS 36, which of the following would definitely NOT be an indicator of the potential impairment of an asset (or group of assets)?

A.An unexpected fall in the market value of one or more assets

B.Adverse changes in the economic performance of one or more assets

C.A significant change in the technological environment in which an asset is employed making its software effectively obsolete

D.The carrying amount of an entity’s net assets being below the entity’s market capitalisation

请帮忙给出每个问题的正确答案和分析,谢谢!

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案